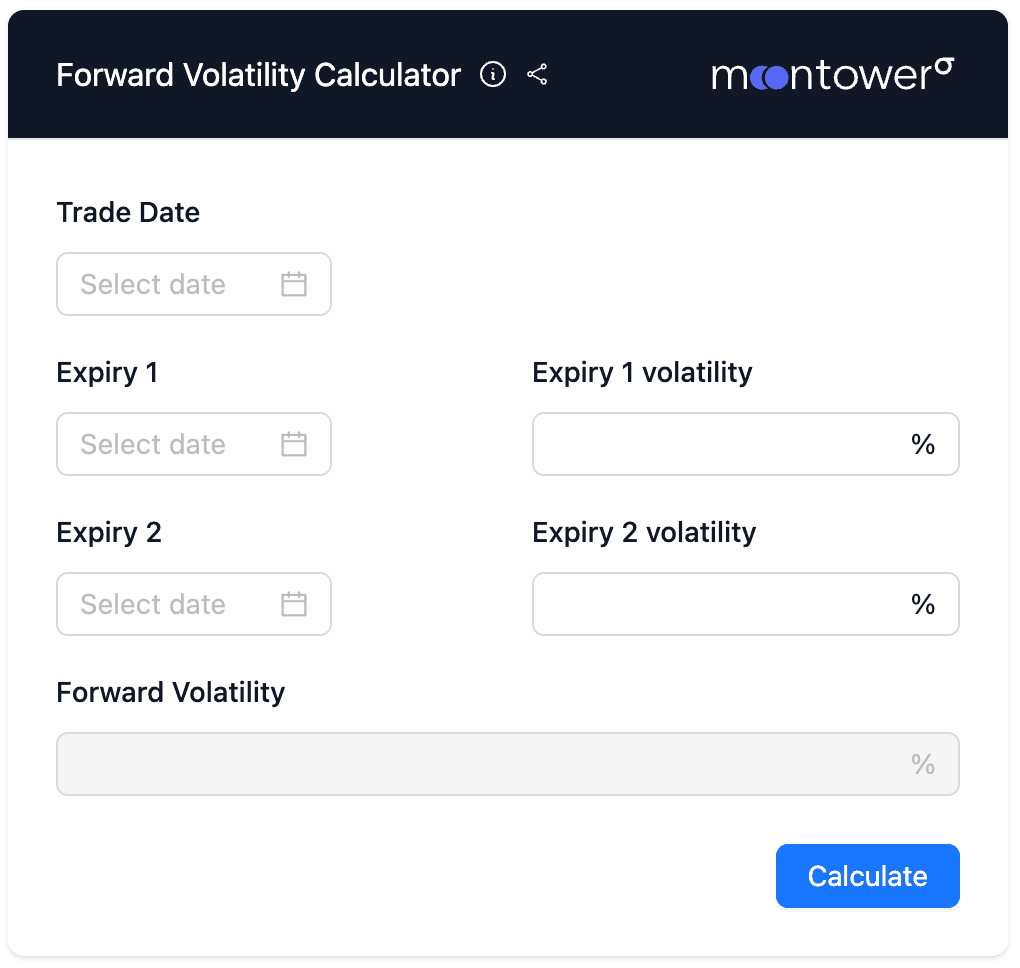

Options Forward Volatility Calculator

The amount of volatility implied by an option price includes any volatility for a preceding expiry.

Given 2 expirations we can effectively subtract the volatility of the near dated expiry from the later dated expiry to imply a forward volatility or the amount of volatility implied in between the 2 expirations.

The details of the computation can be found in Understanding Implied Forwards.

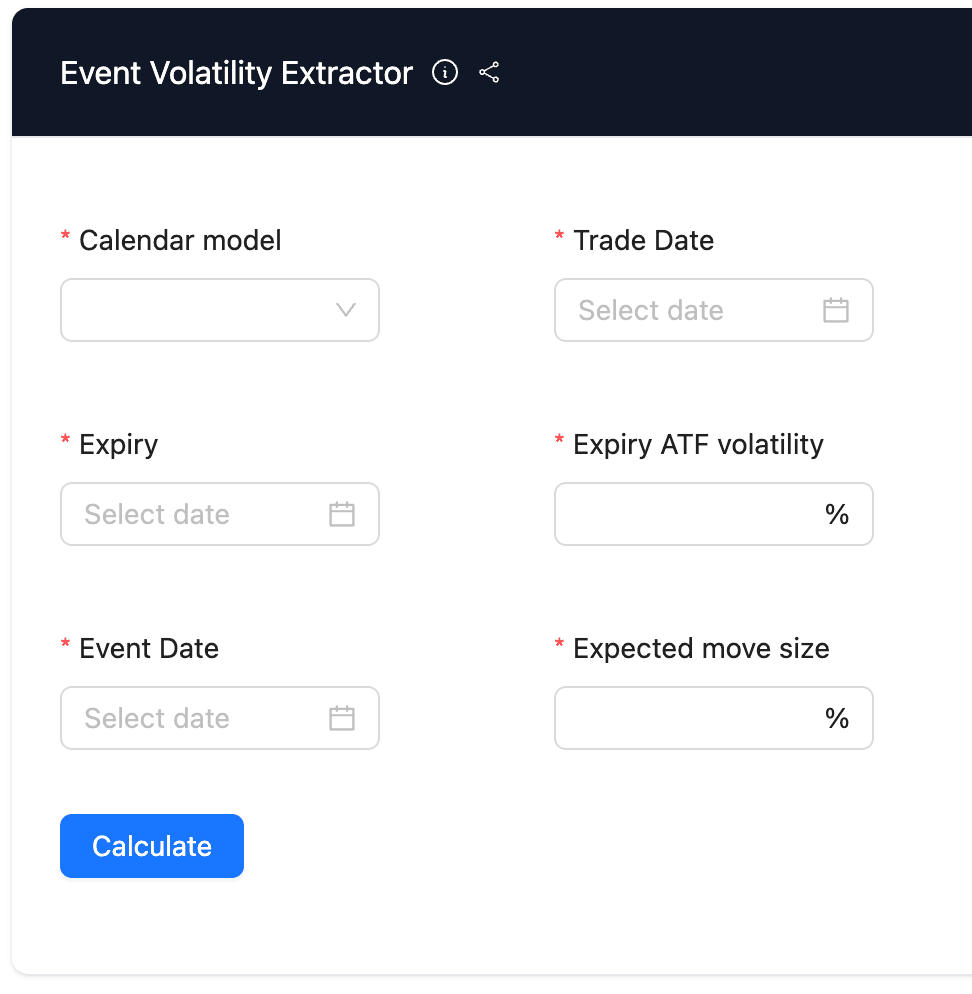

Options Event Volatility Extractor

When the market anticipates events like a stock's earnings date, it often factors increased volatility into the affected option expirations.

Traders analyze this implied volatility by separating it into the volatility for the event day itself and the typical daily volatility.

To do this, a trader estimates an “expected move size” for the event.

The volatility converter can be used to transform an implied volatility from a 365-day model to a 251-day model or vice versa.

Implied volatility is just a number that matches a model to what we actually care about — the real-world traded price of options. If you compare models with different tenors, you will observe different implied volatilities for a given straddle price.

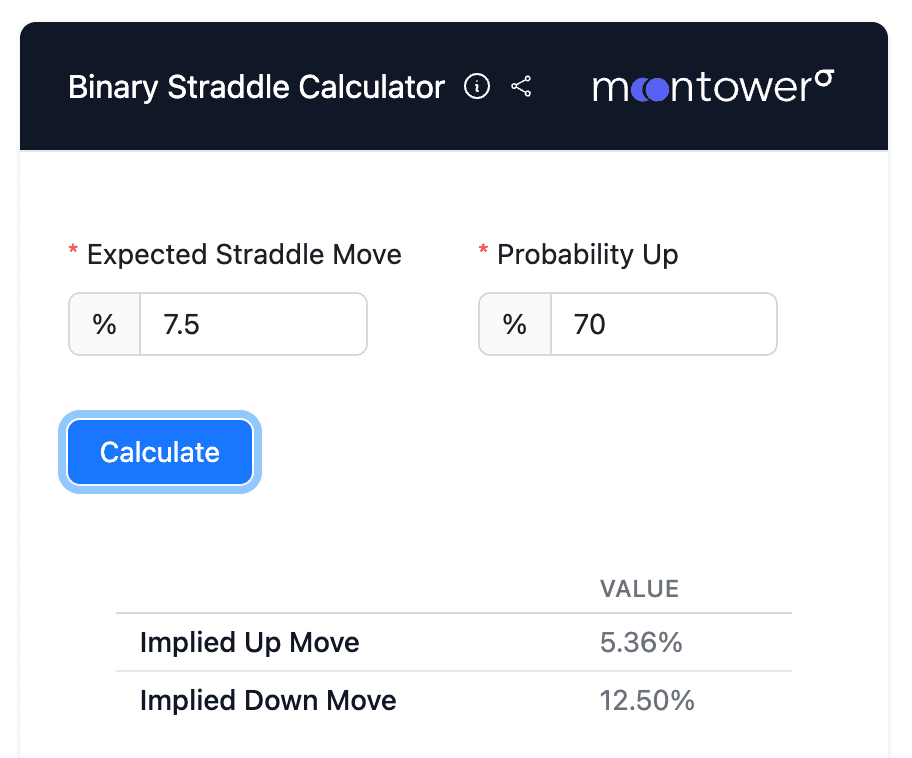

Options Binary Straddle Calculator

If you believe an upcoming move reduces to 2 possible outcomes (FDA ruling, merger arb, election) and can estimate the probability of up vs. down, then the straddle price implies how much the asset is expected to move in either of the 2 directions.

This calculator computes the expected move sizes for a binary event given a straddle price and the probability of an up or down move.

For a detailed example see this article.

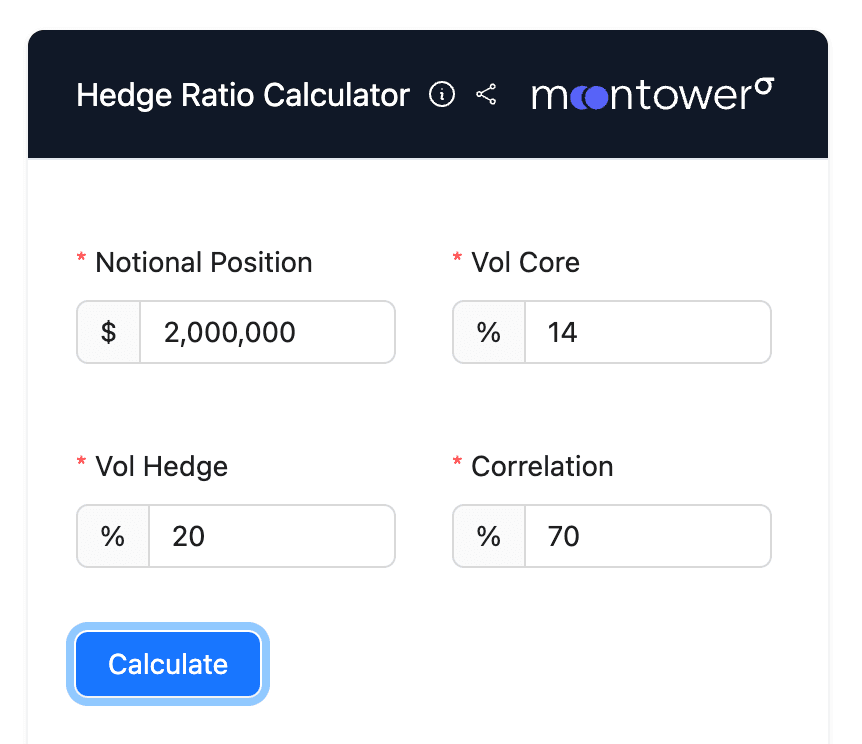

Options Hedge Ratios Calculator

The hedge ratios calculator computes how many dollars of asset B you need to hedge asset A.

Hedge ratios can be useful for long/short pairs, hedging a basket or single stock with an index future, or translating option deltas from one name to another.

A hedge ratio multiples the beta between the 2 assets by the dollar amounts. The main inputs are the volatilities of each asset (implied or realized depending on user preference) and a correlation.

More details on the computation can be found here.

Options Pair Trade Hedge Ratio Calculator

Calculate vega-weighted and theta-weighted hedge ratios for options pair trades.

When trading volatility spreads between two options, you need to determine the optimal hedge ratio. This calculator helps you find the right ratio based on whether you want to neutralize vega, theta, or gamma.

Vega-weighting neutralizes exposure to absolute volatility changes and is best when you believe the vol spread will converge. Theta-weighting neutralizes exposure to proportional volatility changes and is generally more robust.

Learn more about pair trade weighting in this detailed guide.